Written by Daniel Thai, Fluvio Consultant

As a product marketer, you’re used to working throughout the entire product development process. This often means starting with research to identify market fit and positioning for your new product, all the way to building an extensive go-to-market plan to ensure the launch goes smoothly. After months of collaborating and planning with your product and marketing teams, launch day arrives and external communications go out, officially putting your brand new product into the market.

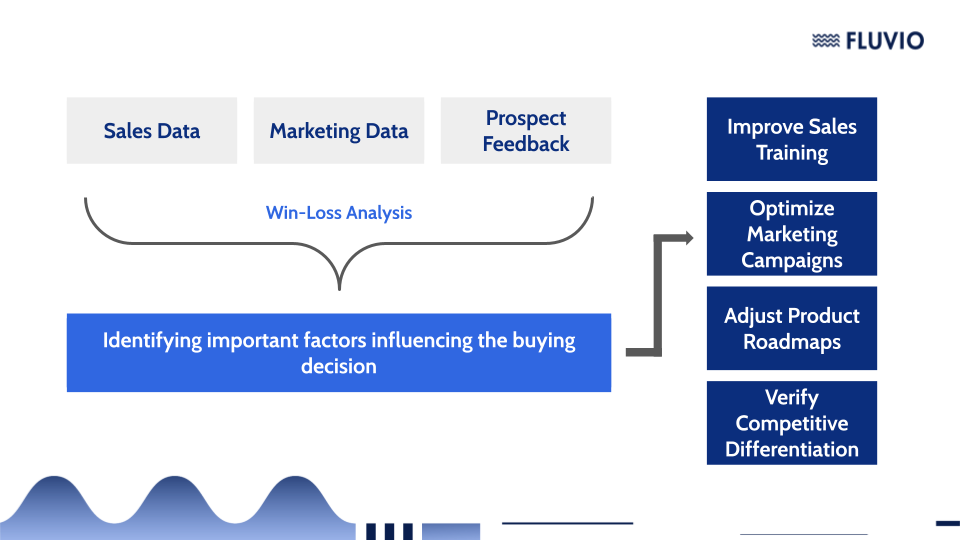

Once in flight, marketing creates awareness and leads, which Sales turns into opportunities and won deals. These metrics serve as the baseline for measuring these teams’ success, but they provide an incomplete picture. In order to evaluate Sales teams’ successes — and learn from the failures — businesses need to take a deeper dive into the buying process with a win-loss analysis.

Identifying Why Customers Buy

Looking at the percentage of opportunities converted into wins provides only a glimpse into why your Sales team is or isn’t successful. A win-loss analysis strives to determine the influencing factors through the customer’s awareness, consideration and decision stages. The main takeaway from such an analysis is understanding why and how customers make their choices, which can benefit teams across the entire organization.

Sales teams can use this information to understand which selling propositions are most impactful to prospects and adjust their training to leverage these key points. Marketing teams can look at the win-loss analysis to verify its messaging and optimize campaigns to address obstacles in the marketing funnel or sales process. Product teams can use this feedback to focus on product improvements.

Leverage and Amplify Your Existing Data

A win-loss analysis looks at three main components: sales data, marketing data, and prospect feedback.

Sales data often comes from your CRM, and includes information such as sales activity, opportunity status, sales notes on prospect needs and why the deal was won or lost.

Marketing data comes from your marketing analytics platform, which measures customer engagement (marketing interactions, website visits, traffic, etc.) through your various channels.

Prospect feedback can be the most difficult piece to obtain, usually through surveys and interviews.

The process begins by identifying data gaps and consequently recommending process improvements to address them. For example, Sales Operations could ensure there are clear fields for “main competitor” and “reason won/reason lost” in the CRM, which could serve as the basis for critical reporting dashboards that go beyond the revenue pipeline. Onboarding could help collect additional feedback on why customers choose to do business with you.

Creating the Playbook

A successful win-loss analysis programmatically brings together these data points to provide recommendations toward winning more customers. Building a playbook that outlines each stakeholders’ responsibilities can go a long way in gaining buy-in and driving efficiencies across teams. This playbook would vary depending on each organization’s structure, but it should include some version of the following elements:

Curated dashboards/reports in your CRM - These dashboards can provide quick, high-level visibility into how well your Sales team is performing and why. These dashboards could track not only win rates, but win rates against competitors and top reasons won or lost against those competitors, for example.

Automated survey for all closed opportunities - Creating a routine - whether it’s a template for the Sales team to send out or an automated process through your CRM - can provide the first touchpoint for direct prospect feedback. In addition, the surveys can help you better quantify and compare the factors that went into the customer decision, such as price, features, presentation, or service.

Internal Sales team opportunity reviews - Work with your Sales leaders to identify key won and lost opportunities that could serve as discussions for certain prospect criteria. One month, they could discuss the sales cycle, challenges, and successes against a core competitor. Another month, they could review different opportunities within a particular industry vertical in detail.

Prospect interviews - The survey responses and opportunities identified in the internal reviews can serve as springboards for prospect interview candidates. These interviews should ideally be conducted within 30 days of closing (ideally, a mix of lost and won) so that the sales experience is still fresh in the prospect’s mind and is not yet influenced by product use. Build a standard set of questions to choose from, and try to keep the interviews under 30 minutes. This is an opportunity to hear directly from the prospect about their purchasing considerations, decision process, and perception of your product.

Regular cadence of recommendations and reports to stakeholders - Teams across the organization will be interested in the findings, so build a recurring meeting (could be monthly, quarterly, whatever works for the number of opportunities being analyzed) and reusable template to present the information to your stakeholders. This consistent analysis will drive additional buy-in and help improve the process as it grows.

The win-loss analysis is an important tool to better understand what customers are thinking during the shopping process. When done properly, teams across the entire organization can gain additional insights to improve their own processes, and ultimately, increase customer acquisition and retention.